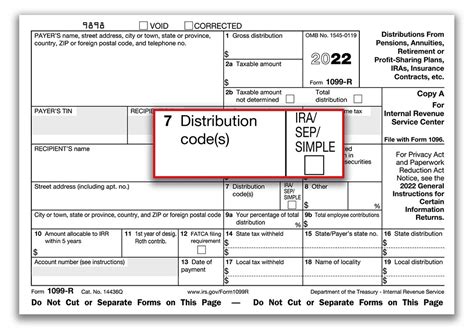

1099 r box 7 distribution code t A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5 .

Whether you are looking to eliminate lead, mercury, arsenic, or other heavy metals from your water supply, our list of the best whole house water filters for heavy metals is here to help you make an informed decision and provide peace of mind knowing that your family’s water is safe and clean.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

There are two basic types of boxsprings. Modern Boxspring: has a metal or wood frame with horizontal pieces that span across the width of the boxspring. These slats support the mattress above, in the same way that the coil boxspring works. A traditional boxspring is anywhere from 8-10″ high.

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax free) distribution .A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to .

May 18, 2023 7:46 AM TurboTax is here to make the tax filing process as easy as .

usb 2.0 junction box

About form 1099-NEC; Crypto taxes; About form 1099-K; Small business taxes; .We would like to show you a description here but the site won’t allow us. A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5 .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

irs distribution code 7 meaning

T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but: The participant has reached age 59 & 1/2; The participant died, or; The participant is disabled.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. U

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

unturned metal sheet id

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan. A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

A code T in box 7 of 1099-R is for a Roth IRA distribution, when an exception applies. It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but: The participant has reached age 59 & 1/2; The participant died, or; The participant is disabled.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

irs 1099 box 7 codes

form 1099 box 7 codes

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. U One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

upgrading junction boxes amazon oa

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

1099 r minimum reporting amount

If you’re short on time, here’s a quick answer to your question: The most effective methods to attach fabric to metal include using industrial-strength adhesives, mechanical fasteners like rivets or screws, or a combination of both, depending on .

1099 r box 7 distribution code t|irs 1099 box 7 codes