cash liquidation distribution box 8 Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these . $98.00

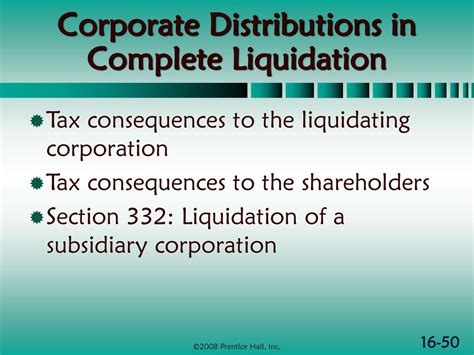

0 · tax consequences of liquidating distributions

1 · payments in lieu of dividends

2 · liquidating distribution tax treatment

3 · irs qualified dividends worksheet

4 · irs qualified dividend

5 · are liquidating dividends taxable

6 · are cash liquidation distributions taxable

7 · 1099 div nondividend distributions

$45.00

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC. If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final .

power distribution box for security cameras

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you . Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule . Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these .

Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R.

power company junction box underground

Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in . What Is a Cash Liquidation Distribution? A cash liquidation distribution, also known as a liquidating dividend, is the amount of capital returned to the investor or business owner when a.

power distribution box car

For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. . You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R.

Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.

Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

tax consequences of liquidating distributions

payments in lieu of dividends

What Is a Cash Liquidation Distribution? A cash liquidation distribution, also known as a liquidating dividend, is the amount of capital returned to the investor or business owner when a.For payments received by a broker on behalf of a customer in lieu of dividends as a result of a loan of a customer's securities, see the instructions for box 8 under Specific Instructions for Form 1099-MISC in the current Instructions for Forms 1099-MISC and 1099-NEC.

If your client receives a cash liquidation distribution, you have to find out the basis in the stock that is being liquidated. Once the distributions exceed basis, or the final distribution is made so you can determine a gain or loss, you put it on Schedule D. .

liquidating distribution tax treatment

You'll receive a Form 1099-DIV from the corporation showing you the amount of the liquidating distribution in Box 8 or 9. Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. Follow these steps to enter 1099-DIV cash or noncash liquidation distributions in the program: Go to Input Return ⮕ Income ⮕ Dispositions (Sch D, etc.). Select Schedule D/4797/etc. In the Quick Entry grid, select Details to expand. Under Dispositions (Sch D, etc.), enter the Description of Property. Proceeds from cash liquidation distributions are reported on Form 1099-DIV. There should be an option on the Div entry screen that your 1099-Div has info in more than these boxes . click that and fill in the box amount for box 8 for the amount reported.

Taxable dividend distributions from life insurance contracts and employee stock ownership plans. These are reported on Form 1099-R.

Understand the financial implications of cash liquidation distributions with our guide on tax treatment, accounting practices, and reporting obligations.Box 8. This box should be left blank if a RIC reported the foreign tax shown in box 7. Boxes 9 and 10. Show cash and noncash liquidation distributions.

Box 9 Cash liquidation distributions - This amount is the cash the investor/taxpayer received upon liquidation of all or part of the underlying entity. Generally the cash distribution is considered a return of the cost or basis in the investment.

power distribution box under hood and 2007 ford freestar

power distribution lunch box

The crescent Wiss straight handle hand Seamer is a powerful tool for bending or flattening sheet metal by hand. It utilizes an optimal handle span to deliver maximum power from an ergonomic operating range, and features non-slip cushion grips for superior comfort and control.

cash liquidation distribution box 8|are liquidating dividends taxable