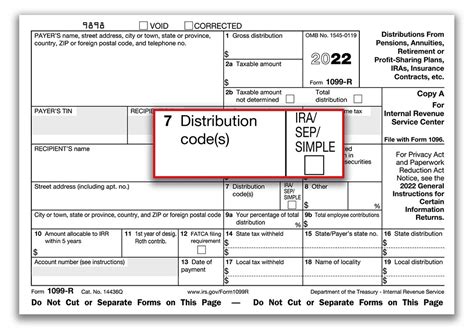

1099 box 7 distribution code 1 This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as .

Sheet metal thickness is vital for vehicle durability. The standard measurement for this thickness is “gauge,” with a higher gauge number indicating a thinner piece of metal. The gauge system is often used in conjunction with .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

Yes, you read it right, cutmen may use an enswell or face iron on a boxer’s face during a match! This small metal iron can come in different shapes depending on the body part it will be applied to: flat enswells for flatter regions like the temple or cheek, and rounded enswells for contoured areas such as around the eye socket.

irs distribution code 7 meaning

bapko metal fabricators north cypress street orange ca

irs 1099 box 7 codes

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross .

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as .

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

ballard metal fabricators

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .What do the codes in the distribution code (s) box of Form 1099-R mean? Early distribution, no known exception, for taxpayers under age 59 ½. Early distribution, exception applies, for taxpayers under age 59 ½. Disability, for taxpayers .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 .

Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

What do the codes in the distribution code (s) box of Form 1099-R mean? Early distribution, no known exception, for taxpayers under age 59 ½. Early distribution, exception applies, for taxpayers under age 59 ½. Disability, for taxpayers avoiding early distribution penalties due to .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).

For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 . Code 1 is used if the distribution is made for medical expenses, health insurance premiums, qualified higher education expenses, a first-time home purchase, a qualified reservist distribution. A governmental section 457 (b) plan distribution that is .

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Metal fabrication is a manufacturing process used to shape metal into parts or end products. Most people think of welding when they hear metal fabrication, but welding is just one process metal fabricators use. We use several techniques to .

1099 box 7 distribution code 1|irs 1099 box 7 codes